Moniepoint launches Moniebook for Nigerian Businesses, Targeting SMEs With an All-in-One POS System

As more Nigerian SMEs struggle with managing sales, inventory, staff, and payments across multiple disconnected tools, Moniepoint has unveiled Moniebook, an all-in-one POS and business management system designed to simplify daily operations for millions of merchants nationwide.

The launch positions Moniepoint—already one of Nigeria’s dominant POS and merchant service providers—to compete directly with OPay Business Hub, PalmPay’s business suite, and emerging SME tools like Kippa.

Moniepoint confirmed the release in a statement on Wednesday, explaining that Moniebook is built specifically for small and medium-sized enterprises (SMEs) and multi-location businesses. The platform recently exited beta testing and is already recording noteworthy early adoption.

Why This Matters

Nigeria has over 40 million SMEs, many of which still rely on manual bookkeeping or separate apps for payments, inventory, staff management, and sales tracking.

Moniebook aims to centralize these operations in one system—reducing stress, preventing losses, and helping business owners make better decisions in real time.

Moniepoint’s Vision for Business Management Tools

Babatunde Olofin, Managing Director of Moniepoint MFB, described Moniebook as a major step in Moniepoint’s mission to empower businesses with advanced tools—not just payment terminals.

“This aligns strongly with our mantra of creating financial happiness as we continue powering the dreams of millions of Nigerians who trust the brand as an enabler of progress,” he said.

According to Olofin, the company wants Moniebook to become a growth partner for merchants across retail, hospitality, food services, supermarkets, pharmacies, and multi-branch outlets.

What Moniebook Offers Nigerian Businesses

Moniebook functions as a full retail and operations system, giving business owners real-time visibility into:

- Sales performance

- Customer activity

- Inventory levels

- Staff productivity

- Branch performance (for multi-outlet businesses)

The platform integrates hardware and software to help users automate manual tasks and make better data-driven decisions.

Moniepoint says Moniebook is available in two pricing tiers:

- Core – ₦6,000/month (for small businesses)

- Pro – ₦8,500/month (for multi-store and advanced operations)

Also read: How Wema Bank, a $552 million bank, Is Supporting Startups Across All Sectors

Why Moniepoint Introduced Moniebook Now

Oluwole Adebiyi, Head of Product at Moniebook, said the system was designed to address real, everyday challenges faced by Nigerian merchants.

“For too long, small and medium-sized business owners have had to juggle multiple, disconnected tools for tracking inventory, processing payments, and understanding their sales data.”

He added that Moniebook allows entrepreneurs to focus more on serving customers, while the system handles record-keeping and branch monitoring.

This positions Moniepoint as not just a payments company, but as a complete business operating system for Nigerian SMEs.

Moniebook vs Existing POS and Business Tools

With this rollout, Moniepoint enters a competitive ecosystem that includes:

- OPay Business Hub

- PalmPay Merchant Tools

- Kippa Payments & Bookkeeping

- Bumpa for e-commerce sellers

Unlike many competitors, Moniebook emphasizes:

- Multi-location management

- Real-time staff monitoring

- Detailed customer analytics

- Integration with existing Moniepoint terminals

- A combined software + hardware model

This makes it especially attractive to supermarkets, restaurants, wholesalers, and other SMEs that operate more than one location.

Key Features of Moniebook

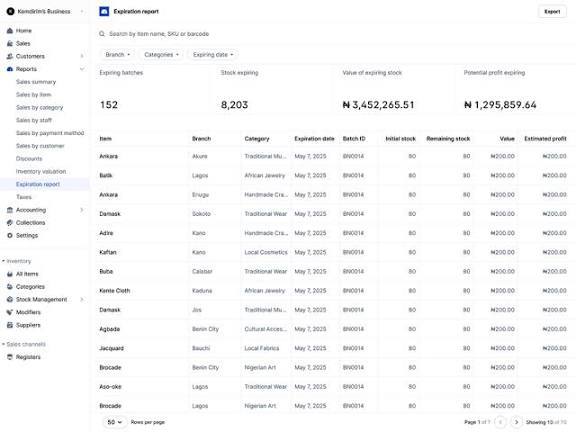

Inventory Management

Track stock levels, reduce waste, and prevent stockouts.

Integrated Payment Processing

Supports seamless, cashless transactions through Moniepoint terminals.

Multi-Location Management

Monitor staff, sales, and inventory across multiple branches from one dashboard.

Sales Tracking & Analytics

Get real-time insights into performance, customer behaviour, and staff productivity.

Extra Registers & Role Management

Businesses can add more registers and assign employee access levels.

Setup & Implementation Support

Assistance for businesses adopting the system for the first time.

FAQs About Moniebook

Is Moniebook the same as a regular Moniepoint POS?

No. While it integrates with Moniepoint POS devices, Moniebook goes beyond payments and includes inventory, staff, analytics, and multi-branch management.

Who can use Moniebook?

Any business—small shops, supermarkets, restaurants, pharmacies, or multi-location outlets.

How much does Moniebook cost?

Core is ₦6,000/month; Pro is ₦8,500/month.

Does Moniebook work for businesses with multiple branches?

Yes. The Pro plan is specifically designed for multi-location enterprises.

Where can businesses access Moniebook?

It is available through Moniepoint’s merchant platform and authorised agents nationwide.