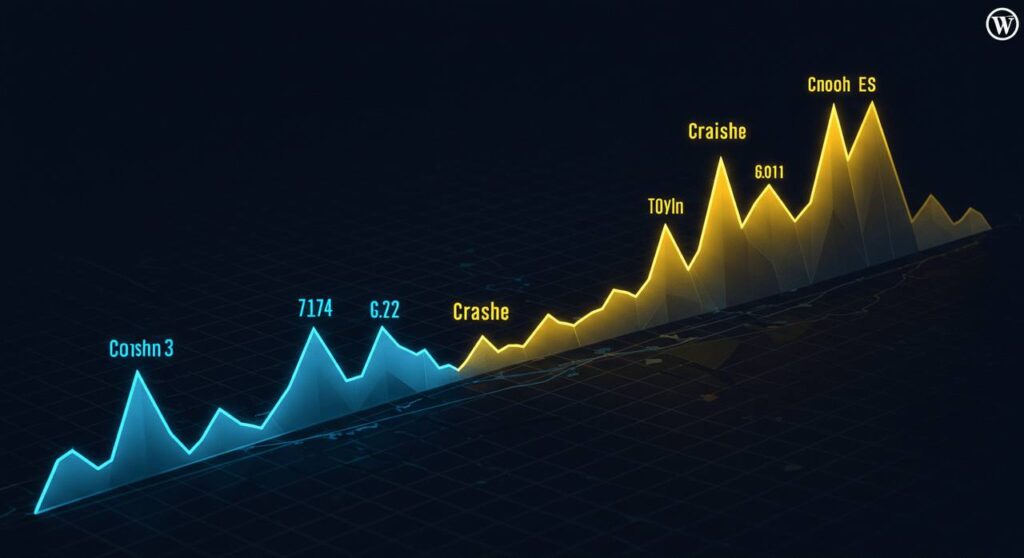

Crypto history is filled with unbelievable highs and devastating lows. From Bitcoin’s first surge to the shocking collapse of major exchanges, the journey of digital assets has been anything but boring. In this article, we’ll walk through seven unforgettable booms and crashes that shaped crypto history — and uncover the lessons investors, developers, and regulators can’t afford to ignore.

1. Bitcoin’s First Boom (2010–2011)

To begin with, Bitcoin’s earliest boom remains one of the most fascinating stories in crypto history. In just over a year, Bitcoin jumped from pennies to $31 in 2011. Yet, almost as quickly, it crashed back down to $2.

This was the first major reminder that volatility is part of crypto’s DNA. While the gains were historic, the crash revealed the risks of hype-driven surges.

Lesson: Even from the start, crypto taught the world that rapid growth almost always comes with rapid decline.

2. The Mt. Gox Meltdown (2014)

Moving forward, one of the darkest chapters in crypto history happened with Mt. Gox, the exchange that once handled 70% of global Bitcoin trades. In 2014, it suffered a massive hack, losing more than 850,000 BTC.

The impact was immediate: Bitcoin’s price was cut nearly in half, and trust in crypto exchanges collapsed overnight.

Lesson: Security failures don’t just affect platforms — they can shake the entire market.

3. The ICO Boom (2017)

Next, we can’t talk about crypto history without mentioning the ICO mania of 2017. Thousands of new tokens launched, raising billions of dollars almost overnight. Bitcoin hit $20,000, while Ethereum climbed to new heights as ICOs were built on its blockchain.

However, many of these projects were scams or simply failed, leading to one of the harshest crashes in crypto history by 2018.

Lesson: Innovation attracts excitement, but unchecked speculation almost always ends in disappointment.

4. The 2018 Crypto Winter

As a result of the ICO bust, crypto entered what became known as the Crypto Winter. Prices froze for more than a year, with Bitcoin dropping from $20,000 to around $3,000. Meanwhile, countless altcoins lost more than 90% of their value.

For many, it felt like the end. But for builders and long-term believers, it was simply another chapter in crypto history.

Lesson: Bear markets test conviction, but they also create space for the next wave of innovation.

5. The DeFi Summer (2020)

Then came a surprise rebound: the DeFi Summer of 2020. Platforms like Uniswap, Aave, and Compound attracted billions in capital, proving that decentralized finance could rival traditional banking models.

This period didn’t just revive the market; it redefined crypto history by showing that real utility — not just speculation — could drive adoption.

Lesson: True booms are built on innovation, not hype alone.

6. Bitcoin’s $69,000 Peak (2021)

Following the DeFi wave, the crypto market reached an all-time high. In November 2021, Bitcoin hit $69,000, while Ethereum soared past $4,800. Fueled by institutional investors, NFT mania, and global media coverage, it felt like crypto had finally “arrived.”

Yet, as history has shown time and again, peaks don’t last forever.

Lesson: Every boom carries the seeds of the next crash, and hype cycles can’t be ignored.

7. The 2022 Crash & FTX Collapse

Finally, the most recent and perhaps most dramatic moment in crypto history came in 2022. The collapse of Terra/LUNA triggered a chain reaction that wiped billions from the market. Soon after, the shocking bankruptcy of FTX, one of the largest crypto exchanges, left investors stunned.

Bitcoin fell below $20K, trust in centralized exchanges evaporated, and regulation pressures increased worldwide.

Lesson: In crypto, no institution is too big to fail. Transparency and accountability matter more than ever.

Final Thoughts

Looking back, crypto history is not a straight line — it’s a rollercoaster of extreme highs and crushing lows. Every boom brings innovation, and every crash forces the industry to mature.

If there’s one takeaway, it’s this: crypto history always repeats itself — but every cycle brings us closer to a more resilient future.

Crypto history proves that every boom is followed by a crash — and vice versa. Don’t just watch from the sidelines. Stay updated with our blog for insights, analysis, and the latest trends shaping the future of digital assets.

Related Posts

Crypto: Best 5 Essential DeFi Projects Dominating September 2025

Is Crypto Taxed in Nigeria? Everything You Need to Know (2025)

Best 10 Cryptocurrencies Set to Surge in September & October